4.8: Bookkeeping

One everyday use of adding and subtracting decimals is the bookkeeping we all must do with our money.

Here are some examples:

- Keeping track of online payments.

- Figuring out how much money to take on a trip.

- Stretching a pay cheque over two weeks.

- Organizing the household budget.

- Deciding how much you can spend on eating out.

What are some other examples of bookkeeping that you do?

The bookkeeping that most of us do is straightforward:

- Add money received or deposited to our accounts.

- Subtract money spent or paid out.

The result of the addition or subtraction is the balance.

Methods of Payment

There are many different methods of paying for purchases. Some of the most common methods are:

- cash

- debit card

- credit card

- cheque

- online payment (i.e., PayPal, e-transfer)

There are benefits to each payment method. Each person chooses to do what works best for them, depending on the situation. Here is a list of some of the benefits and drawbacks of each method of payment.

Cash

Advantages:

- It is quick and easy to pull money out of your wallet.

- You can see how much money you have left.

- It is impossible to overspend.

- It is a great method to use if you do not have a bank account.

Disadvantages:

- It is easier to lose.

- You may need to continue to visit the bank to get money out.

- You might run out of cash while trying to pay at the till.

Debit Card

Advantages:

- It is quick at the till.

- You cannot spend more than you have in your bank account.

- It is safe.

Disadvantages:

- There is often a service fee when using the card to pay for shopping.

- You cannot always use it for online shopping.

Credit Card

Advantages:

- You only have to pay the company money once a month.

- It is quick at the till.

- It is easy to track your spending because the credit card company sends you a monthly statement.

- You can use a credit card for online shopping.

Disadvantages:

- It is really easy to overspend your budget because you do not have to pay any money upfront.

- There are often service charges once a year that are expensive.

- You can get into debt with a credit card, and it may be difficult to get out of that debt.

Cheque

Advantages:

- It can be convenient when you want to mail someone money.

- It is safe.

- The chequebook helps you keep a written record of your bank balance.

Disadvantages:

- Some stores do not accept cheques or require several pieces of identification, usually a driver’s licence and a credit card.

- Most banks and credit unions have a small service charge for each cheque that you write.

- If your account is overdrawn, your cheque will be N.S.F. (Not Sufficient Funds), for which you are charged extra by the store and the bank. To avoid this, keep careful, up-to-date records so you always know your balance.

Online Payment

Advantages:

- It allows you to shop online securely.

- You can pay directly online with money from your bank account or credit card.

- You can easily send money to friends or family.

Disadvantages:

- You may not have the rights that regular banks give you when you use an online payment company.

- The company is not local, so any problems may be hard to resolve.

- There are fees charged to have an online payment account.

No matter what payment method you choose to use, it is very helpful to keep track of your money. You can use a record book to track when you spent money and when you were paid money. This will help with budgeting and planning.

Online Banking

Many people use online banking to keep track of their finances. When online banking, you will see a record of your transactions that looks something like Table 4.8.1.

| Date | Transactions | Debit | Credit | Running Balance |

|---|---|---|---|---|

| 2023-01-29 | Electronic Funds Transfer PAYCHEQUE | — | 175.00 | 1439.66 |

| 2023-02-23 | Internet Banking INTERNET BILL PAY TELUS COMMUNICATIONS | 65.49 | — | 1374.06 |

| 2023-03-10 | Electronic Funds Transfer DEPOSIT CANADA | 125.00 | — | 1499.06 |

| 2023-03-16 | Internet Banking E-TRANSFER Larissa | 100.00 | — | 1599.06 |

The transactions are usually recorded in chronological order by date and time.

Here is a description of each column:

- Date — The date of the transaction. The examples given use this method: 2023-01-29. January 29 is the 29th day of the 1st month.

- Debit — This is money that has gone out of the account, either through a withdrawal, a bill payment, or a transfer out.

- Credit — This is money deposited into the account, either through a cash deposit, a paycheque, or a transfer in.

- Running Balance — The amount in the bank account after each transaction.

Exercise 1

Look carefully at this sample online banking transaction record in Table 4.8.2, and answer the questions that follow.

| Date | Transactions | Debit | Credit | Running Balance |

|---|---|---|---|---|

| — | Balance Forward | — | — | 121.16 |

| 2022-03-29 | Electronic Funds Transfer PAYCHEQUE | — | 675.62 | 798.78 |

| 2022-03-30 | Internet Banking INTERNET BILL PAY MCCARTHY GM | 175.40 | — | 621.38 |

| 2022-03-30 | Internet Banking INTERNET BILL PAY BC HYDRO | 50.27 | — | 571.11 |

| 2022-04-05 | CASH DEPOSIT | — | 25.00 | 596.11 |

| 2022-04-08 | Internet Banking INTERNET BILL PAY CITYWEST | 19.80 | — | 576.31 |

| 2022-04-09 | INTERAC PAYMENT MAVERICK FOODS | 128.54 | — | 447.77 |

| 2022-04-09 | CASH WITHDRAWAL | 30.00 | — | 417.77 |

- How much money was in the account at the beginning of this transaction record (balance forward)?

- Name the month when the Citywest online bill payment happened.

- What is the amount of the interact payment to Maverick Foods?

- How much was the pay deposit?

- What was the balance after the B.C. Hydro transaction?

- How many deposits were made to the account?

- What is the total amount of the deposits?

Exercise 1 Answers

- April

- $128.54

- $675.62

- $571.11

- $121.16

- 2

- $700.62

Exercise 2

Complete the transaction record in Table 4.8.3 using the information in Table 4.8.4 below.

Continue to fill out the “Running Balance” column as you add each credit or debit.

| Date | Transactions | Debit | Credit | Running Balance |

|---|---|---|---|---|

| — | Balance Forward | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

| — | — | — | — | — |

Information to use for question:

| Date | Details | Transaction |

|---|---|---|

| April 23, 2022 | Balance forward | $210.83 |

| April 25, 2022 | Cash withdrawal | $45.00 |

| April 28, 2022 | Debit to Maverick Mart | $99.95 |

| April 30, 2022 | Pay deposit | $843.29 |

| May 1, 2022 | Online payment Mark Jones for rent | $420.00 |

| May 3, 2022 | E-transfer to Kathy Smythe (for Facebook raffle) | $25.00 |

| May 6, 2022 | Interac payment to Chevron gas | $18.27 |

| May 8, 2022 | Cash withdrawal | $110.00 |

| May 10, 2022 | Online bill payment for Mastercard | $150.00 |

| May 12, 2022 | Deposit Child Care Tax Credit | $66.48 |

| May 13, 2022 | Interac payment Maverick Mart | $183.00 |

| May 15, 2022 | Pay deposit | $792.18 |

Exercise 2 Answers

| Date | Transactions | Debit | Credit | Running Balance |

|---|---|---|---|---|

| 2022-04-23 | Balance Forward | — | — | 210.83 |

| 2022-04-25 | Cash withdrawal | 45.00 | — | 165.83 |

| 2022-04-28 | INTERAC PAYMENT MAVERICK FOODS | 99.95 | — | 65.88 |

| 2022-04-30 | Electronic Funds Transfer PAYCHEQUE | — | 843.29 | 909.17 |

| 2022-05-01 | Internet Banking INTERNET BILL PAY MARK JONES | 420.00 | — | 489.17 |

| 2022-05-03 | Internet Banking E-TRANSFER KATHY SMYTHE | 25.00 | — | 464.17 |

| 2022-05-06 | INTERAC PAYMENT CHEVRON GAS | 18.27 | — | 445.90 |

| 2022-05-08 | Cash withdrawal | 100.00 | — | 335.90 |

| 2022-05-10 | Internet Banking INTERNET BILL PAY MASTERCARD | 150.00 | — | 185.90 |

| 2022-05-12 | DEPOSIT CANADA CHILD TAX CREDIT | — | 66.48 | 252.38 |

| 2022-05–013 | INTERAC PAYMENT MAVERICK MART | 183.00 | — | 68.38 |

| 2022-05-15 | Electronic Funds Transfer PAYCHEQUE | — | 792.18 | 861.56 |

Cheque Writing

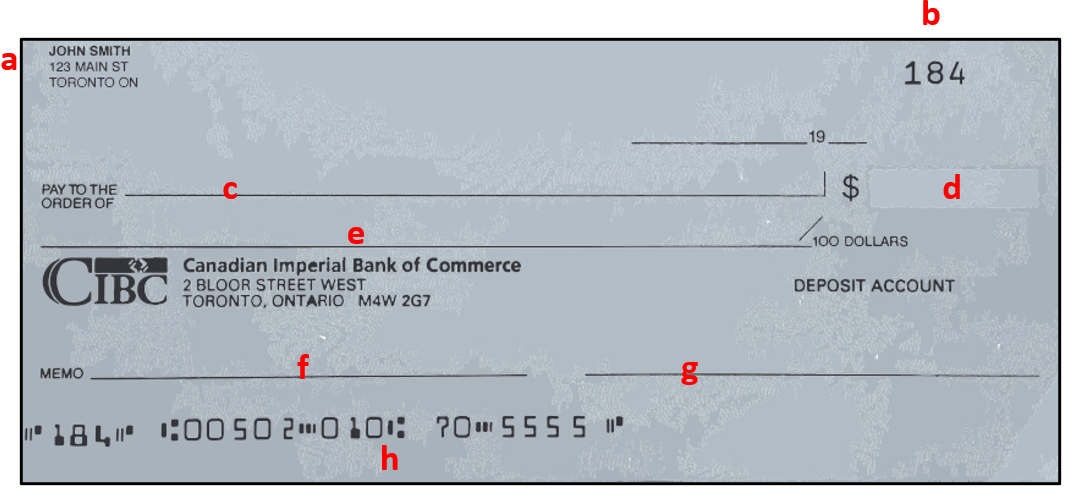

Figure 4.8.1 shows an example cheque with the following information:

- When you have a chequing account, you sometimes have cheques printed with your name, address and phone number, usually in the top left corner.

- The cheques are numbered in sequence (in order) to help you keep track of your cheques.

- This line is for the name of the person or institution that will be receiving the money.

- This line is for the amount of the cheque in numbers: $22.98.

- This spot is for you to write, in words, the dollars to be paid. Write the cents as a fraction over 100. If you do not use the whole line, fill unused parts of the space with a straight line so that nothing can be added. $22.98 becomes twenty-two and 98⁄100 dollars.

- The Memo spot is a place for details. It is useful if you want to use the cheque as a receipt, too. For example, you might list the invoice number for the bill you are paying.

- When you open a bank account, the bank will ask you for a sample signature for their files. Sign exactly as you plan to sign your cheques.

- Your bank account number and codes used at the bank will be printed on your cheques.

As soon as you write a cheque, be sure to enter the details in your chequebook.

A chequebook is a simple accounts book or ledger. A ledger is a convenient way to record expenditures (money spent) and income.

Exercise 3

Use the information in Table 4.8.6 and Table 4.8.7 below to complete the chequing account ledger in Table 4.8.8.

Arrange the information in chronological order. That means put the information with the earliest date first, then the next date, and so on.

| Date | Cheque # | Details | Debit |

|---|---|---|---|

| 2022-05-01 | #122 | Mortgage payment | $375.00 |

| 2022-05-06 | #123 | Cable | $32.17 |

| 2022-04-23 | — | E-transfer Mike the Mechanic | $45.82 |

| 2022-04-18 | #121 | B.C. Hydro (Feb & Mar) | $62.53 |

| 2022-03-02 | — | Cash withdrawal | $75:00 |

| 2022-03-02 | — | Debit charge | $1.50 |

| 2022-05-04 | — | Grocery Mart | $111.95 |

| Date | Details | Credit |

|---|---|---|

| 2022-04-30 | Pay | $596.27 |

| 2022-04-15 | Birthday money | $200.00 |

| 2022-04-20 | Child Care Tax Refund | $33.64 |

Chequing account ledger to complete:

| Date | Cheque # | Transaction | Debit or Cheque Amount | Deposit Amount | Balance |

|---|---|---|---|---|---|

| — | — | Balance forward |

— | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

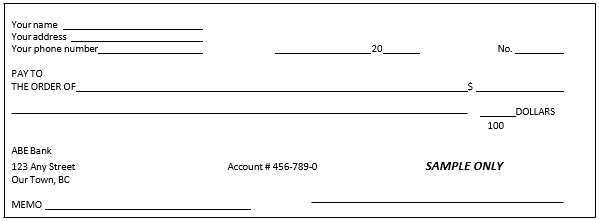

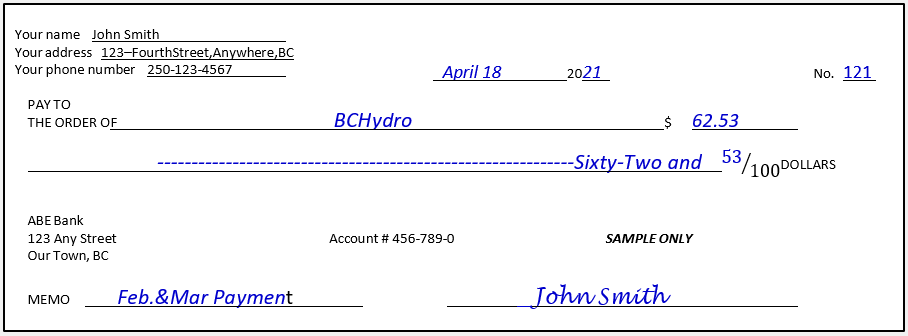

Use the cheque blank in Figure 4.8.2 to write out cheque # 121 from Table 4.8.6. Use any name and address you want. Ask your instructor to check your work.

Exercise 3 Answers

| Date | Cheque # | Transaction | Debit or Cheque Amount | Deposit Amount | Balance |

|---|---|---|---|---|---|

| — | — | Balance forward |

— | — | 312.07 |

| 2022-03-02 | — | Cash Withdrawal | 75.00 | — | 237.07 |

| 2022-03-02 | — | Debit charge | 1.50 | — | 235.57 |

| 2022-04-15 | — | Birthday money | — | 200.00 | 435.57 |

| 2022-04-18 | 121 | BC Hydro (Feb & Mar) | 62.52 | — | 373.04 |

| 2022-04-20 | — | Child Care Tax Refund | — | 33.64 | 406.68 |

| 2022-04-23 | — | Mike the Mechanic (fix shocks) | 45.82 | — | 360.86 |

| 2022-04-30 | — | Pay | — | 596.27 | 957.13 |

| 2022-05-01 | 122 | Mortgage Payment | 375.00 | — | 582.13 |

| 2022-05-04 | — | Grocery Mart | 111.95 | — | 470.18 |

| 2022-05-06 | 123 | Cable | 32.17 | — | 438.01 |

Attribution

All figures in this chapter are from Topic C: Bookkeeping in Adult Literacy Fundamental Mathematics: Book 4 – 2nd Edition by Katherine Arendt, Mercedes de la Nuez, and Lix Girard, via BCcampus.

This chapter has been adapted from Topic C: Bookkeeping in Adult Literacy Fundamental Mathematics: Book 4 – 2nd Edition (BCcampus) by Katherine Arendt, Mercedes de la Nuez, and Lix Girard (2023), which is under a CC BY 4.0 license.